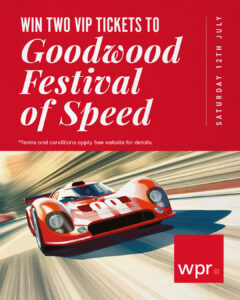

Goodwood Festival of Speed

Instruct Warren Powell-Richards to sell or let your property throughout May and June and you’ll enter a prize draw to win a pair of VIP tickets for Saturday 12th July worth over £2,000*. The winner will receive the Clark package, which includes: Veuve Clicquot NV reception Unlimited Veuve Clicquot NV, house wine,